how to declare mileage on taxes

If you do gig work as an employee your employer should withhold tax from your paycheck. The standard IRS mileage rate for the 2021 tax year is 056miles.

Mileage Tax Deduction Claim Or Take The Standard Deduction

The standard mileage rate for 2021 taxes is 56 cents per mile driven for business 585 cents per mile for 2022.

. The most important tax deduction for rideshare drivers is the mileage deduction since it will be your biggest driving expense. As of January 1 2019 the IRS set the standard mileage rate at 58 cents per mile driven for business use 20 cents per mile driven for medical purposes and 14 cents per mile driven in service of charitable organizations. Calculate your total wages salaries and tips for the year.

Finally you may want mileage for Medical reasons This will be under Deductions and credits. You would figure your standard mileage rate deduction on IRS Form 2106 and report this amount on Schedule A of IRS Form 1040. The federal rate then the amount over 625 cents per mile multiplied by the mileage will be considered taxable income.

The standard mileage rate for business use is based. If you use your vehicle for business 80 of the time that means you will be able to claim 80 of your total vehicle expenses on your taxes. Record this figure in Box 7 of Form 1040 labeled Wages salaries tips etc Attach each W-2 to support the figure.

This rate fluctuates yearly and applies to vehicles including cars trucks and vans. Rates in cents per mile. You must pay tax on income you earn from gig work.

How To Declare Taxes As An Independent Consultant Sapling Business Mileage Lularoe Business Business Tax. How do I deduct mileage on taxes. The mileage tax deduction is calculated by multiplying qualified mileage by the annual rate set by the Internal Revenue Service.

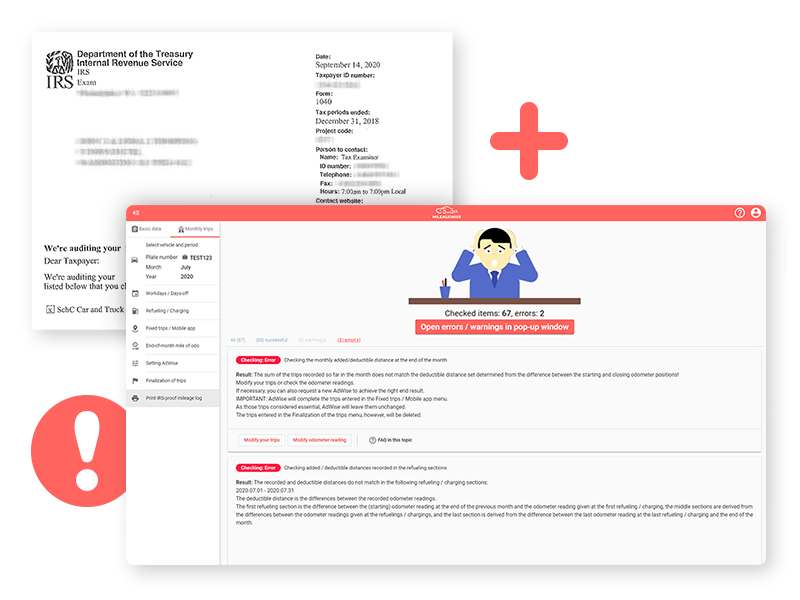

In the past mileage logs were often paper records but now more people use mileage tracking apps designed to automate this process. If the employer pays a mileage rate that exceeds the 2022 IRS business rate ie. The rate is for the use of a car van pickup truck or panel truck.

If youre self-employed or an independent contractor however you can deduct mileage used solely for business purposes as a business-related expense. Calculate your total work-related mileage. There are two ways to claim the mileage tax deduction when driving for Uber Lyft or a food delivery service.

A mileage reimbursement is not taxable as long as it does not exceed the IRS mileage rate the 2022 rate is 625 cents per business mile. All tax tips and videos. There are two ways to calculate mileage reimbursement.

For qualifying trips for medical appointments the rate is 016mile. Multiply that number by the standard mileage rate for 2021. Scroll down and select Medical On drop-down select Medical Expenses Start.

How to declare mileage on taxes. Tax calculators. Reimbursement typically takes the form of a certain dollar amount for each mile driven on company business.

For the 2021 tax year the rates are. Tax Tools and Tips. Brought to you by Sapling.

You must file a tax return if you have net earnings from self-employment of 400 or more from gig work even if its a side job part-time or temporary. This number is the sum of the amount in Box 1 of all your W-2 forms plus any unreported tips. For example if your only miscellaneous deduction is 5000 of mileage expenses in a year you report an AGI of 50000 you must reduce the deduction by 1000 50000 times two percent.

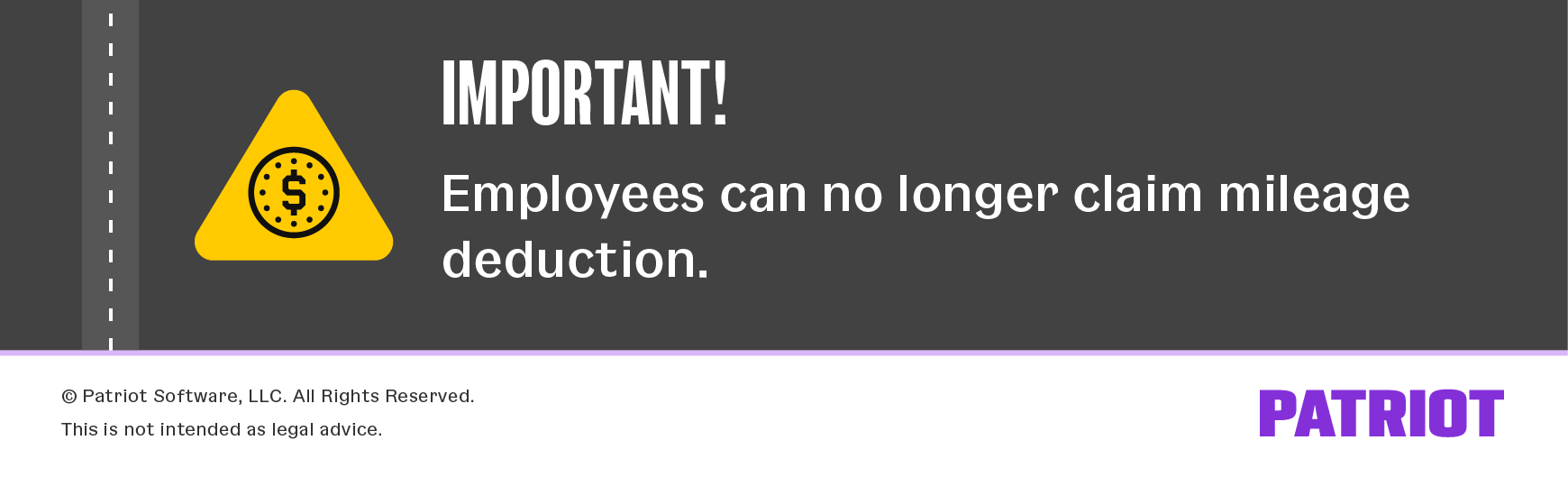

If you do gig work as an independent contractor you. If you used your car for a business that you own you would claim your standard mileage deduction on Schedule C of IRS Form 1040. Business expenses for employees are generally non-deductible as of the Tax Cuts and Jobs Act of 2017 TCJA.

If you are an employee you cannot deduct gas mileage as an unreimbursed expense on your tax return. If the mileage rate exceeds the IRS rate the difference is considered taxable income. Multiply the standard mileage rate by your total miles driven or determine your actual expenses for the year including mileage depreciation of your car and other costs.

The detail of your expenses will be shown on either Form 2106 or 2106-EZ which is used to report employee business expenses. Under Expenses Click Add Expenses for this work Scroll and select Vehicle Add Go to the bottom of the page Continue Vehicle will now appear on your entry page. Multiply your business miles driven by the standard rate 56 cents in 2021.

56 cents per mile for business miles driven down 15 cents from 2020 16 cents per mile driven for medical or moving purposes down 1 cent from 2020 14 cents per mile driven in service to a charitable organization. Alternately you can use the actual expense method to deduct the. The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of operating an automobile for business charitable medical or moving expense purposes.

Gathering their mileage report from MileIQ. Check e-file status refund tracker. For volunteer work the rate is 014mile.

Can You Deduct Business Mileage On Your Taxes

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Self Employed Mileage Deduction Guide Triplog

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

How Do Food Delivery Couriers Pay Taxes Get It Back

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

How To Declare Your Vehicle A Business Vehicle For Taxes Carvana Blog

Self Employed Mileage Deduction Guide Triplog

Can You Deduct Business Mileage On Your Taxes

Top Tax Deductions For Consultants Turbotax Tax Tips Videos

How To Claim Mileage And Business Car Expenses On Taxes

Mileage Log Creator In 7 Mins Auto Populating Trips Retrospectively

Federal Tax Laws On Mileage Reimbursement Turbotax Tax Tips Videos

Self Employed Mileage Deduction Guide Triplog

Self Employed Mileage Deduction Rules Your Guide To Deducting Mileage

Mileage Vs Actual Expenses Which Method Is Best For Me

25 Printable Irs Mileage Tracking Templates Gofar