nassau county property tax rate

Learn all about Nassau County real estate tax. Nassau County Tax Lien Sale.

But the impact on revenue of revaluing a homeworth about 400000 on average countywideis negligible next to the impact of revaluing a commercial propertyworth well.

. Complete guide covering the Nassau County property tax rate county town village school taxes due dates Nassau County property search payments more. What is the property tax rate in Nassau County. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of median property taxes.

Read on to learn more about the property tax rates in Nassau and Suffolk County. The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of 074 of property value. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

How do I calculate my Nassau County taxes. RELATED STORY -- Nassau County Judge Dismisses Property Tax Lawsuit Claiming New Assessments Violate Constitutional Rights Taxes are up for veteran Donald Patane in Levittown too. Are taxes going up in Nassau County.

For New York City tax rates reflect levies for general city and school district purposes. Of the sixty-two counties in. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900.

Nassau County New York. The median property tax also known as real estate tax in Nassau County is based on a median home value of and a median effective property tax rate of 179 of property value. We hope you had a great holiday season and that your new year is treating you well thus far.

Since 2008 Nassau Countys property tax rate went from 564 to 447. Nassau County 1 local option. Purchases of tangible personal property made in other states by persons or business entities for use in Florida Manufacturers on the cost price of products removed from inventory for their own use.

What is the property tax rate in Nassau County NY. So if your tax jurisdiction determines that the value of your property is 200000 and the tax rate is 2 your tax bill comes out to 4000. Rules of Procedure PDF Information for Property Owners.

Secondly owners in every class are eligible to challenge their assessments. But not everyones situation is the same and tax rates can varysometimes greatlythroughout the County. Assessment Challenge Forms Instructions.

It is also linked to the Countys Geographic Information System GIS to provide. How much are property taxes on Long Island. In Nassau County the average tax rate is 224 according to SmartAsset.

Assessed Value AV x Tax Rate Dollar Amount of Taxes. Nassau County New York has a high property tax rate compared to the rest of the Empire State. What is the Nassau County Property Tax Rate.

How to Challenge Your Assessment. Whereas the typical New Yorker pays 123 a year in property taxes Nassau County residents pay on average 179 or roughly 8711 a year. In Nassau County the average tax rate is 224 according to SmartAsset.

How much is property tax in Long Island NY. His house is. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

3 discount if paid in the month of December 2 discount if paid in the month of January 1 discount if paid in the month of February Full amount if paid in the month of March no discount applied The full amount is due by March 31st and if not paid becomes delinquent on April 1st Payment Options Pay Online Pay in person Pay by mail. In dollar terms Westchester County has some of the highest property taxes not only in the state of New York but in the entire country. Municipalities None 6 sales and use tax applies to.

Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of. Nassau County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. So a 1 mill increase in the rate if approved by voters will still be less than the.

In Nassau County the average tax rate is 224 according to SmartAsset. Claim the Exemptions to Which Youre Entitled. The tax rates for all the other taxing jurisdictions in which your property is located are added together and that consolidated tax rate per hundred multiplied by the assessment of your property equals your property tax for county town and special district purposes.

Whether you are already a resident or just considering moving to Nassau County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. State 6 imposed upon the list below. The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property photographs past taxes tax rates exemptions with amounts and comparable sales.

New York City and Nassau County have a 4-class property tax system. Nassau County uses a simple formula to calculate your property taxes. Nassau County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax.

What is the Nassau County Property Tax Rate. Download all New York sales tax rates by zip code. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc.

While its far too early to tell exactly what kind of year 2022 will be from a Nassau County property tax perspective its clear there are certain things that taxpayers can rely upon and be concerned about as this new year unfolds. Taxes for village or city purposes and for school purposes are billed separately. Those rates were changed last year too by the county raising the portion of taxes paid by residential homeowners.

Nassau County collects on average 179 of a propertys assessed fair market value as property tax. Even so the average effective property tax rate in Suffolk County is 237 far above both state and national averages. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of median property taxes.

Why Are Property Taxes So High In Long Island New York

Fulton County Residents Who Live In A Home They Own May Be Able To Reduce Property Taxes By Making Sure They Are Ta Property Tax Mortgage Rates Property Values

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

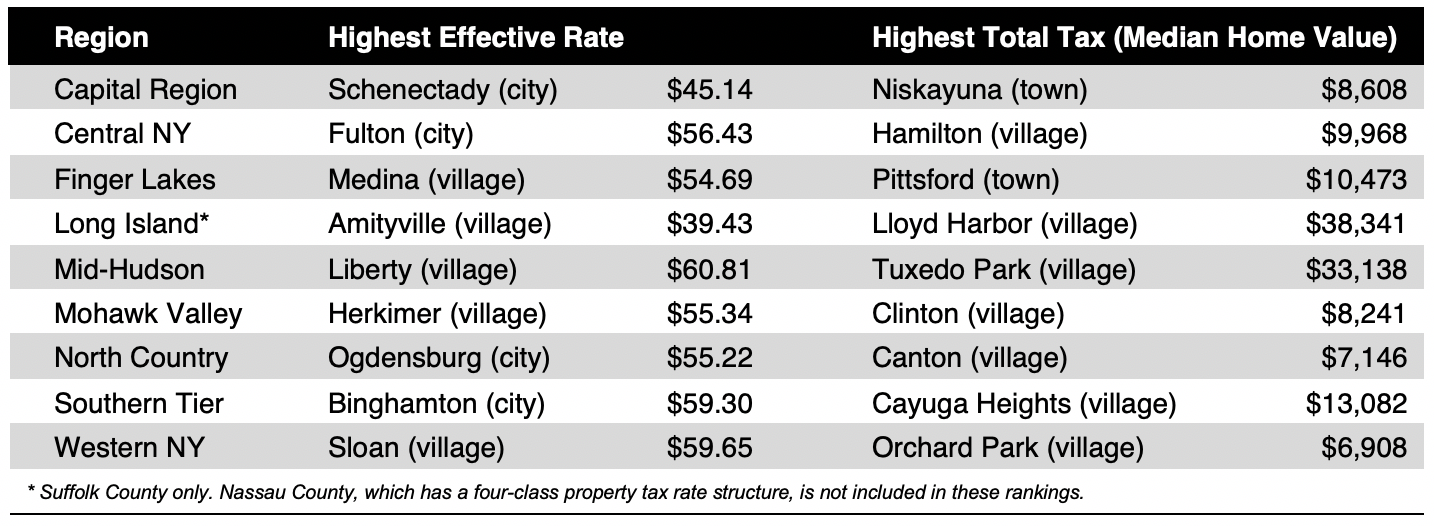

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Nyc Tax Bill On Sale 55 Off Www Ingeniovirtual Com

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Property Taxes In Nassau County Suffolk County

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Definitive Guide To Property Taxes In 2021 Suffolk Nassau Ny

New York Property Tax Calculator 2020 Empire Center For Public Policy

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Sorting Through The Property Tax Burden Tax Policy Center

Homebuyer Sentiment Sinks To A 10 Year Low Amid Tight Supply Yahoo Finance Refinance Mortgage Real Estate Salesperson Mortgage

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

All The Nassau County Property Tax Exemptions You Should Know About

U S Property Taxes Levied On Single Family Homes In 2016 Total More Than 277 Billion Attom

Compare Your Property Taxes Empire Center For Public Policy